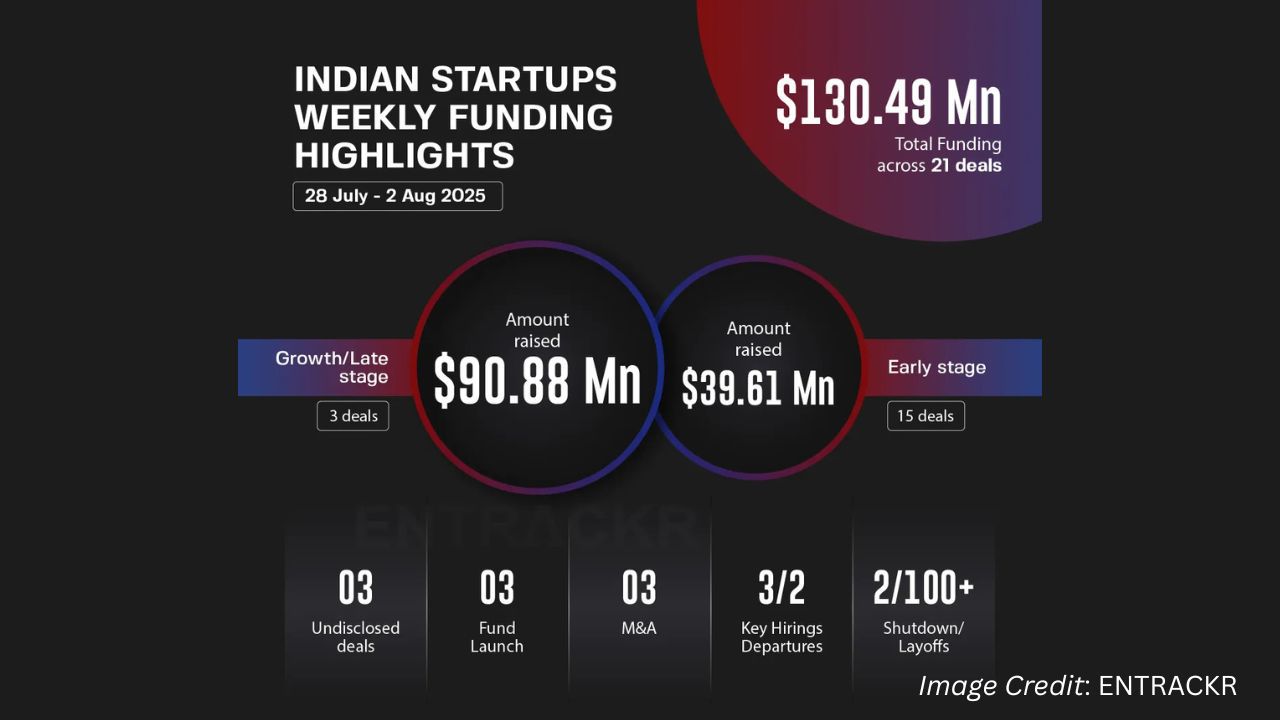

In a week marked by contrasting headlines, the Indian startup ecosystem witnessed a notable slowdown in funding activity. A total of 21 startups collectively raised $130.49 million across different stages — a significant 35.65 percent decline from the $202.79 million secured by 23 startups in the previous week.

Growth-Stage Slowdown: Safe Security Tops the Chart

Only three growth and late-stage deals were struck this week, contributing a combined $90.88 million. Leading the pack was cybersecurity firm Safe Security, formerly known as Lucideus, which bagged a hefty $70 million in a Series C round led by Avataar Ventures. Fintech unicorn Navi Technologies followed with a ₹170 crore ($20 million approx.) debt round, backed by investors including PhillipCapital, NDX Finserve, and Arpee Group. Meanwhile, Zepto, the fast-growing quick commerce platform, secured Rs 7.5 crore in funding from Elcid Investment.

Also Read| India Flips the Semiconductor Script: From Consumer to Global Powerhouse

Early-Stage Energy: AI and SaaS in the Spotlight

The early-stage landscape was more vibrant, with 15 startups raising a total of $39.6 million. Among the key winners was AI startup Metaforms, which led the funding tally with a $9 million Series A round spearheaded by Peak XV Partners. Other notable startups securing early-stage capital included gaming platform STAN, edtech player Arivihan, agentic AI venture Bhindi.io, and SaaS solution provider Sharpsell.ai. However, the amount raised by startups such as Acko, Vahan AI, and Optipro remained undisclosed.

Also Read| Meet ‘Talk to Write’: The AI Tool That Turns Speech Into Handwriting

City & Segment Trends: Bengaluru Maintains Lead

Bengaluru retained its crown as the top startup city with 8 deals, trailed by Delhi-NCR with 6. Mumbai, Guwahati, and other cities also featured on the funding map this week. Sector-wise, artificial intelligence startups led with three notable deals, followed closely by SaaS and e-commerce sectors, which also clinched three deals each. Other sectors like fintech, gaming, and cybersecurity saw moderate activity.

Series-Wise Breakdown: Seed Deals on Top

In terms of funding stages, seed deals dominated with six investments. This was followed by Series A, pre-Series A, and pre-seed deals, each clocking in three deals. There was also activity in Series C, Series F, and debt rounds, albeit to a lesser extent.

Also Read| This Isn’t Sci-Fi: Poland’s Volonaut Builds Real Flying Bike

Hiring, Departures, and Leadership Changes

Despite the funding slump, there was movement in leadership roles across several startups. E-commerce enablement platform GoKwik appointed Vargab Bakshi as its Chief Growth Officer to spearhead its global expansion, product-led growth, and marketing strategies. Verse Innovation—the parent firm of DailyHunt and Josh—named Rohit Sandal as its new Chief Human Resources Officer (CHRO), while electric mobility firm Magenta Mobility brought Ankur Bhandari on board as its Head of Finance. Meanwhile, there were some high-profile exits. Maya John stepped down from her role as Chief People Officer at VerSe Innovation, and Raheel Shah, co-founder and Chief Business Officer at NBFC Eduvanz, also announced his departure.

M&A Activity: Strategic Deals Unfold

Mergers and acquisitions continued to shape the ecosystem. Vahan.ai announced the acquisition of digital learning and upskilling platform L.earn, developed by GoodWorker and backed by LemmaTree. Additionally, expense management firm Zaggle is set to acquire fintech startup Rivpe Technology Private Limited — popularly known as Rio.Money — in a cash deal estimated at Rs 22 crore (around $2.5 million).

New Funds: Capital Pools Keep Growing

Despite the funding dip for startups, the investment ecosystem saw a boost. W Health Ventures launched its second fund of $70 million focused on healthcare innovations in India. Neo Asset Management closed the first round of its Rs 2,000 crore Neo Secondaries Fund, raising Rs 750 crore. Inflection Point Ventures also introduced ‘IPV International’, a $110 million Angel Fund under GIFT City’s IFSCA framework. This fund will invest globally in early- to pre-Series A-stage startups, with ticket sizes ranging from $100K to $1 million.

Also Read| Meet India's Newly launched AI Job Trainer

Shutdowns & Layoffs: Storm Clouds Gather

It wasn’t all sunshine for the startup world this week. AI-powered sales automation platform Astra—backed by Perplexity AI’s Aravind Srinivas—announced that it was shutting down operations. Another casualty was Plus Gold, a digital gold savings platform previously featured on Shark Tank, which also closed shop. AI unicorn Krutrim made headlines for laying off over 100 employees in its second round of job cuts. The company cited a strategic shift toward leaner teams and optimised resource allocation.